Definition

E-wallet is a commonly used payment tool in e-commerce shopping activities. Electronic money stored in an electronic wallet, such as electronic cash, electronic change, electronic credit cards, etc. Shopping with electronic wallet. This is usually done in an electronic wallet service system.

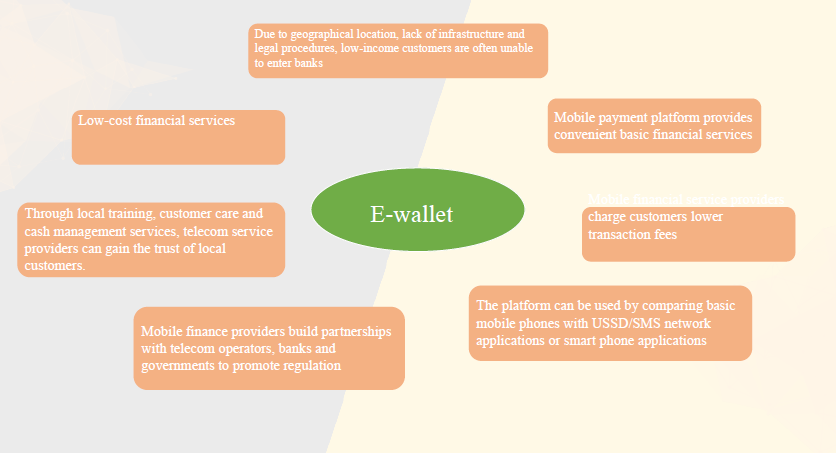

Demand

1. Customers who do not use or have limited access to formal banking facilities are allowed to use a range of financial services via mobile phones.

2. Customers can bind bank accounts, collect money from others, pay or transfer money to others, pay utilities and other services online through APP.

3. Customers can use 2G mobile phones to access distributed services through a vast network of agents.

4. Customers can access it 7*24 hours a day, and realize sending and receiving local and international remittances, face-to-face payment and payment services through digital wallets and agents.

Payment Scenario

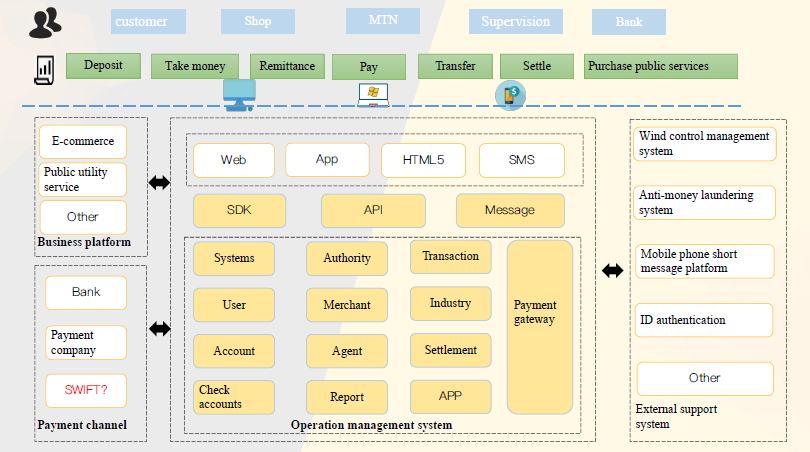

Multiple payment methods:

- QR (quick response) code

- Short message code

- bar code

Line payment:

Face-to-face transaction scenario of offline stores (active code scanning by merchants and active code scanning by customers)

Online payment:

Use online trading scenarios such as PC/APP/H5 Mall/SMS Script.

Cross Border Scenarios

The Application of Electronic Wallet in Hong Kong.

Background

The payment activities of foreign nationals coming to China and domestic nationals leaving the country are still mainly cash payment and bank card payment. Cash payment is difficult to change and not easy to carry, and bank card payment is difficult to cover small and high-frequency consumption scenarios such as bus/subway/roadside snack bars. These are the pain points of cross-border payment. Cross-border people have an urgent need for electronic payment.

Application

Through the process design and system transformation, it is possible to realize the consumption of Hong Kong residents using digital RMB after entering Hong Kong and the consumption of mainland residents using digital RMB after entering Hong Kong.

Solve

1. Make up for the lack of electronic payment in the cross-border payment scenario;

2. Solve the pain point of cross-border flow of digital RMB exchange funds.

Focus

Take advantage of BOC’s first-Mover advantage in cross-border areas to gain more cooperation opportunities for B-end and C-end customers, so as to establish a wider cooperative relationship.

Innovate

1. Use the wallets (cashboxes) of financial institutions to solve the cross-border problem of funds;

2. Give full play to the market service capability of the Bank of China Hong Kong Branch.

Case1-BOC

BOC E-wallet

The electronic wallet has been successfully used in Hongkong, providing 7*24 fast access for overseas tourists to purchase goods in Hongkong and Mainland China

As shown in the figure below, BOC e-wallet can realize the functions of balance display, top up, withdrawal, bank card binding, etc.

Case2- E-wallet Pilot Project of ICBC Xinjiang Branch

ICBC e-wallet

And solves the problem that a large number of branches cannot be set up to carry out business in a wide area. The demand of consumers for indiscriminate use of financial services is met. Access to different businesses creates a business ecosystem with operators as the system.

As shown in the case on the left, ICBC E-wallet can support functions such as deposit, top up, presentation, wealth management, bank card binding, transaction record inquiry, bonus points plan and customer service entrance.